In 2022, we examined how Russia’s invasion of Ukraine disrupted Africa’s wheat supply, triggered fuel price hikes, and opened unexpected opportunities for local maize millers. Three years later, global markets have mostly stabilised — but the threats to Africa’s food systems have intensified. Internal conflict, climate shocks, and soaring logistics costs are now the leading challenges. Yet these pressures also reveal critical opportunities for Africa’s millers and farmers.

Key Insight: Internal conflicts now outweigh global markets in driving food insecurity across Africa.

Opportunity: Local maize and wheat milling is key to creating resilient, affordable food systems.

From global shocks to local strains

The original blog focused on disruptions caused by the Russia-Ukraine war. At the time, 37% of Sub-Saharan Africa’s wheat and maize imports came from those two countries. Prices soared, fertiliser became scarce, and transport costs surged. While many of these indicators have improved, food insecurity in Africa has worsened. That shift reveals a deeper truth: local instability, not global markets, now drives the food crisis.

Internal conflicts are the primary drivers

Conflict within African countries has become the single largest contributor to hunger. In Sudan, nearly two-thirds of the population urgently needs aid, with agriculture dismantled and famine conditions confirmed. The Democratic Republic of Congo faces similar devastation, with millions displaced and maize flour prices rising as much as 37%. In the Sahel, violence and displacement threaten over 10 million people, while agricultural output in places like Niger and Mali has fallen sharply. Ethiopia, Somalia, and South Sudan all face soaring malnutrition rates, collapsed local markets, and disrupted aid delivery.

Conflict doesn’t just reduce food production — it severs supply chains, spikes prices, and cuts off access entirely.

Other conflicts with ripple effects

Beyond Africa, geopolitical developments continue to shape the continent’s food security outlook. In the Red Sea, Houthi attacks on cargo vessels have added $15–25 per ton to East Africa’s cereal costs and increased delivery times by up to two weeks. Meanwhile, demand shocks from the Gaza conflict are pushing Middle Eastern grain buyers to source from African countries like South Africa and Argentina. Political instability in the Sahel — especially the dissolution of ECOWAS ties — is increasing trade costs while also prompting greater interest in local milling investments.

Structural barriers in African grain supply chains

High input costs remain a barrier, especially for fertiliser and fuel. While global prices have eased, local access remains limited due to poor infrastructure and distribution bottlenecks. Transport inefficiencies, especially in conflict zones, contribute to an estimated 37% loss of locally produced food in transit (FAO, 2024). Climate change is intensifying these problems, with extreme weather slashing yields and undermining farmer profitability. Adding to this, uneven price transmission means consumer prices don’t fall as quickly as producer prices, disproportionately hurting the poorest households.

Opportunities for millers and farmers

Despite these challenges, the path forward is clear — and full of potential. Strengthening local production through climate-resilient seed varieties, expanded irrigation, and improved extension services is critical. Adoption of drought-tolerant maize and heat-resilient wheat has already boosted yields in countries like Ethiopia and could be replicated more broadly.

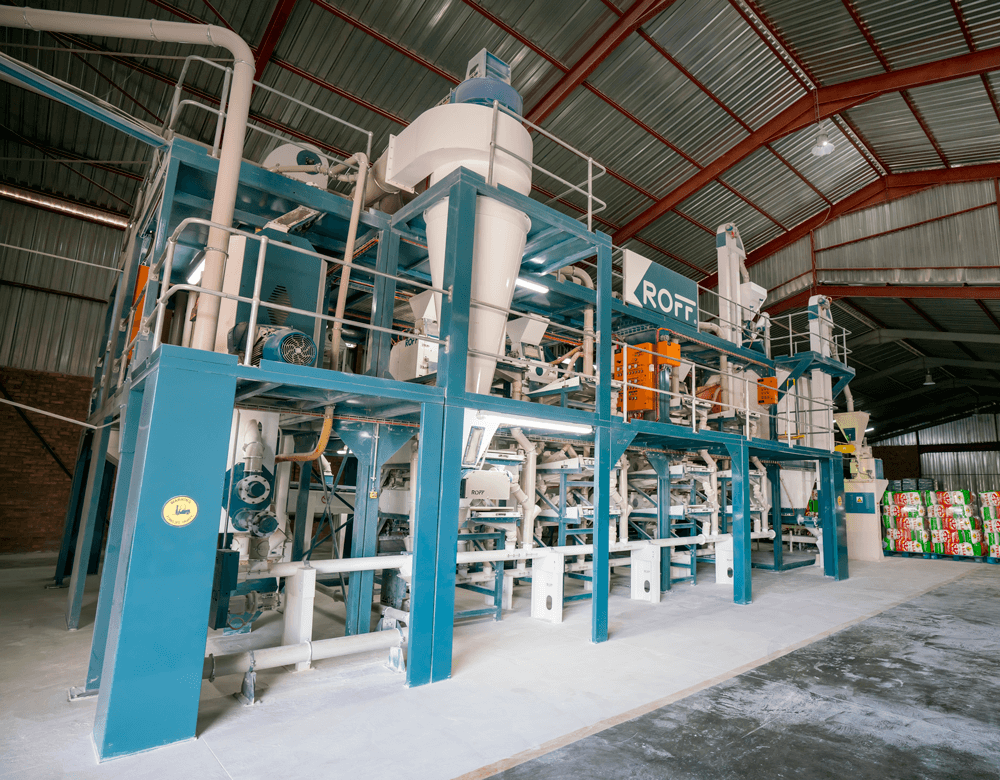

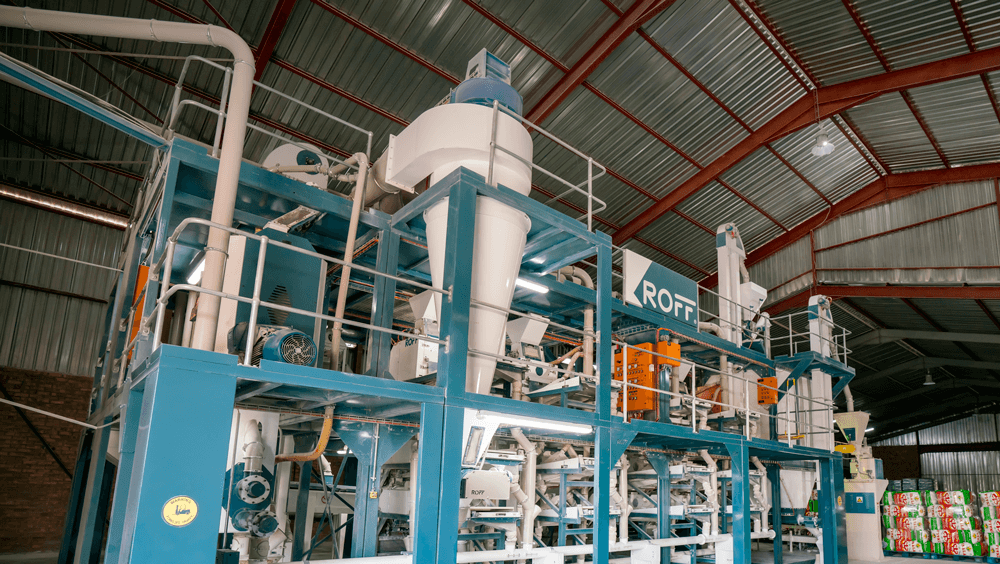

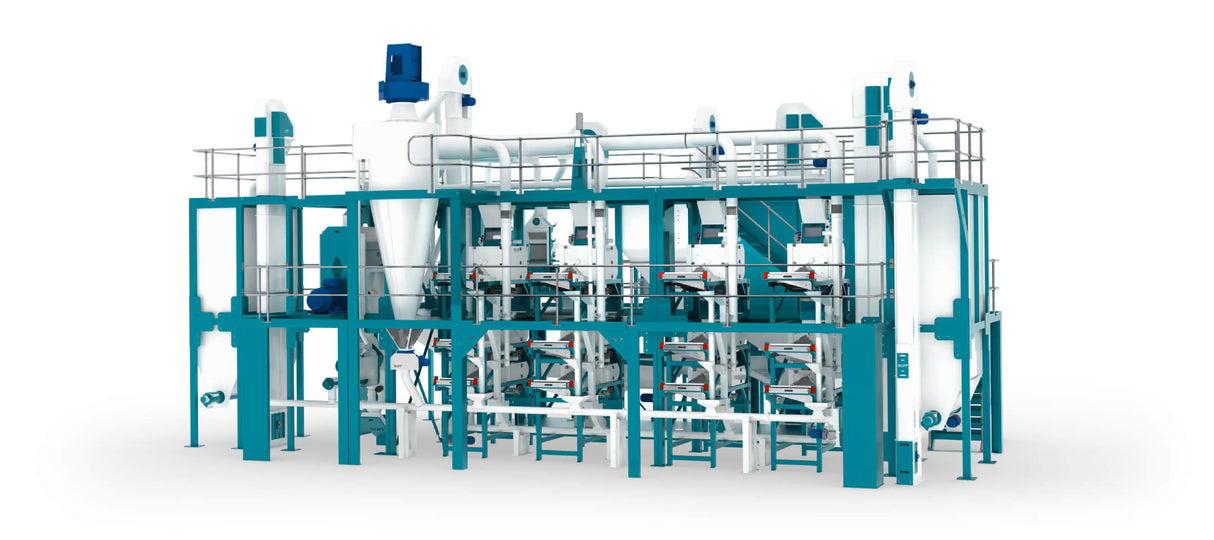

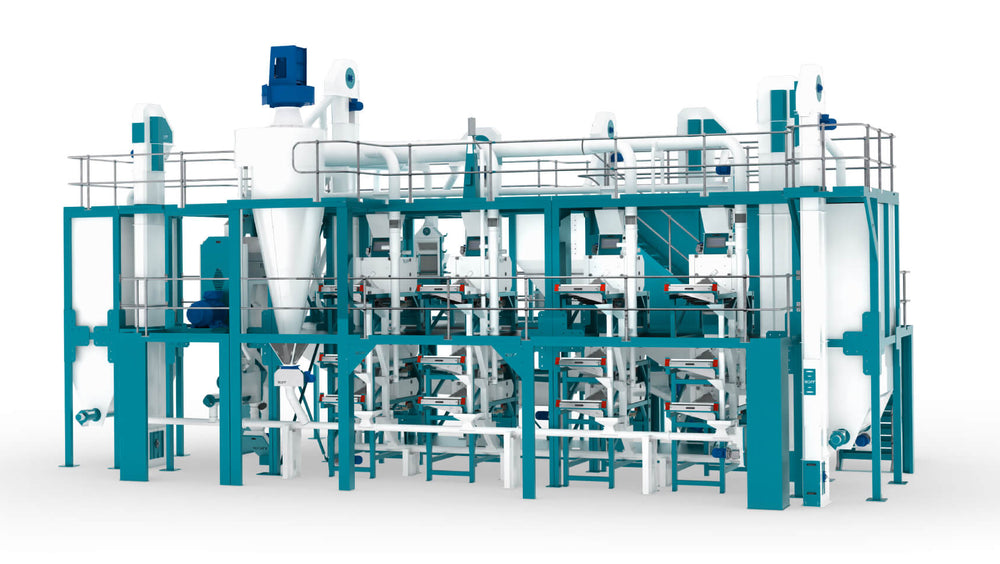

Modernising milling operations can also offer big gains. Investing in advanced roller mills — such as those designed by Roff — allows millers to extract the maximum value from maize, boosting profitability and improving product quality. This not only increases customer satisfaction but helps secure a greater market share. Roff mills also provide the flexibility to supply multiple markets and regions across borders, especially as local supply chains become fragmented or limited. Diversifying your product line — from fortified maize meal to cereals — opens new revenue streams, including opportunities in donor-funded and relief-supported regions where nutritional standards are a key requirement.

Improved trade within Africa holds huge promise. The African Continental Free Trade Area (AfCFTA) offers a framework to remove barriers and connect markets. But realising this potential requires investment in transport and storage infrastructure and better systems for linking smallholder farmers to buyers. Smart logistics, contract farming, and certification programs can all support this.

Finally, enabling policy environments are essential. Governments must support local production over imports, promote public-private partnerships, and expand financial inclusion for farmers and SMEs. Innovative finance models and access to climate funds can empower farmers to adopt new tools and improve resilience.

Africa’s grain future is local

Africa has more than 60% of the world’s uncultivated arable land, but remains a net food importer. The solution lies in building strong, resilient local systems. That means investing in farmers, empowering millers, modernising infrastructure, and encouraging regional trade. Roff Milling stands ready to support this transformation.

Are you ready to future-proof your milling business?

Partner with Roff Milling to upgrade your technology and improve your efficiency. Let’s build a food-secure Africa — one maize mill at a time.

References

Bah, A. (2024, June 10). ECOWAS breakup could push up food prices and worsen hunger in West Africa. The Conversation. https://theconversation.com/ecowas-breakup-could-push-up-food-prices-and-worsen-hunger-in-west-africa-249195

AfCFTA Secretariat. (n.d.). Official Website. https://afcfta.au.int/

African Development Bank (AfDB). (n.d.). Sahel Regional Page. https://www.afdb.org/en/countries/north-africa/sahel

AGRA. (n.d.). Official Website. https://agra.org/

Bah, A. (2024, June 10). ECOWAS breakup could push up food prices and worsen hunger in West Africa. The Conversation. https://theconversation.com/ecowas-breakup-could-push-up-food-prices-and-worsen-hunger-in-west-africa-249195

Bureau for Food and Agricultural Policy (BFAP). (n.d.). Official Website. https://www.bfap.co.za/

CIMMYT. (n.d.). Official Website. https://www.cimmyt.org/

Food and Agriculture Organization of the United Nations (FAO). (2022, April 8). Impact of the war in Ukraine on global food security and FAO’s response. https://www.fao.org/newsroom/detail/impact-of-the-war-in-ukraine-on-global-food-security-and-fao-s-response/en

Food and Agriculture Organization of the United Nations (FAO). (n.d.). Democratic Republic of Congo Emergency Operations. https://www.fao.org/country-profiles/emergency-operations/current-emergencies/drc/en/

Food and Agriculture Organization of the United Nations (FAO). (2023, November 28). Food loss and waste in Africa. https://www.fao.org/food-loss-reduction/news/detail/en/c/1667232/

Global Alliance for Improved Nutrition (GAIN). (n.d.). Official Website. https://www.gainhealth.org/

International Fertilizer Development Center (IFDC). (n.d.). Africa Page. https://ifdc.org/where-we-work/africa/

Intergovernmental Panel on Climate Change (IPCC). (2022). Working Group II – Impacts, Adaptation and Vulnerability. https://www.ipcc.ch/report/ar6/wg2/

OCHA. (n.d.). Horn of Africa Page. https://www.unocha.org/horn-africa

Reuters. (2024, January 29). Red Sea shipping attacks add to Africa grain import costs. https://www.reuters.com/markets/commodities/red-sea-shipping-attacks-add-africa-grain-import-costs-2024-01-29/

UNHCR. (n.d.). Sahel Emergency. https://www.unhcr.org/emergencies/sahel-emergency

World Bank. (n.d.). Africa Region Overview. https://www.worldbank.org/en/region/africa

World Food Programme (WFP). (n.d.). Sudan Country Page. https://www.wfp.org/countries/sudan