Since the start of 2022, world news has been dominated by Russia’s invasion of the Ukraine. The economic impact this war and sanctions imposed on Russia is set to have on the rest of the world will reverberate for years to come.

In the immediate future, we must be prepared for shortages in wheat and fertiliser, of which Russia is a major producer, as well as rapidly climbing oil prices. But with many Africas countries importing as much as 50% of its wheat from countries including the Ukraine and Russia, and bread as a staple food expected to now become unaffordable to many, an opportunity exists for maize producers and maize millers to step up to the plate.

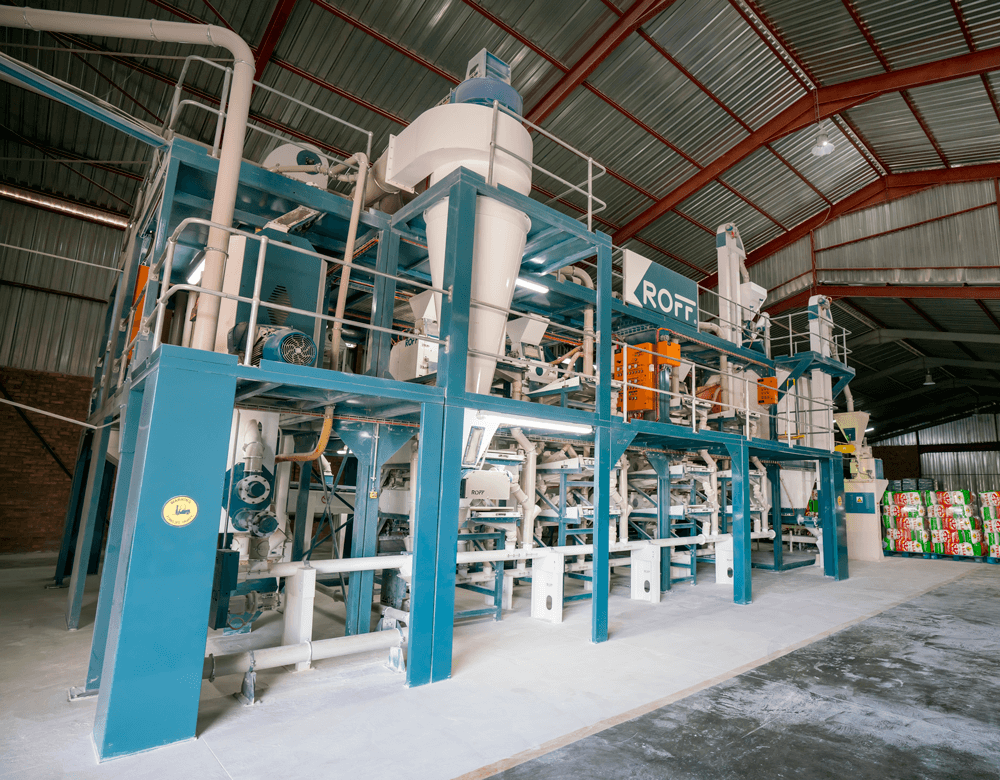

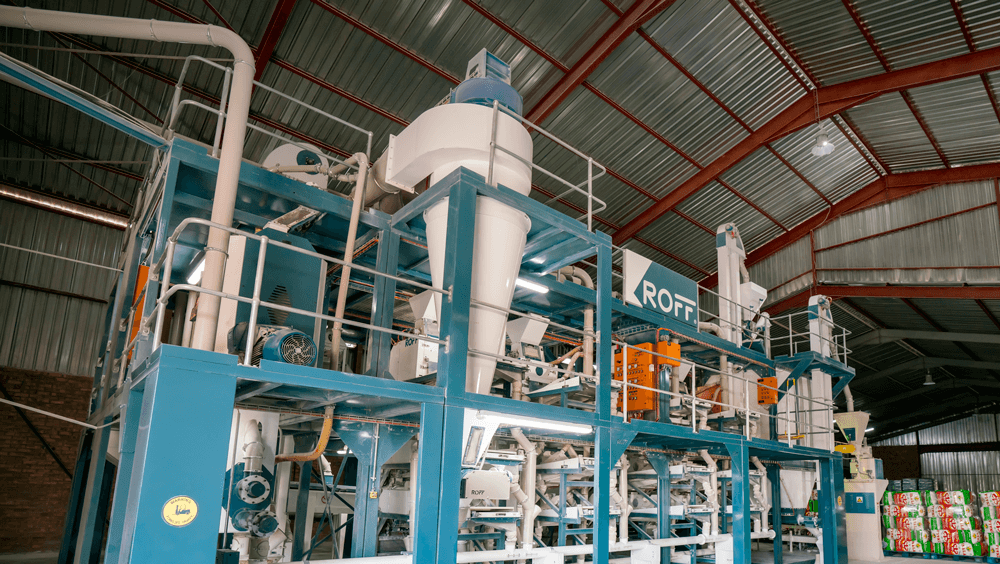

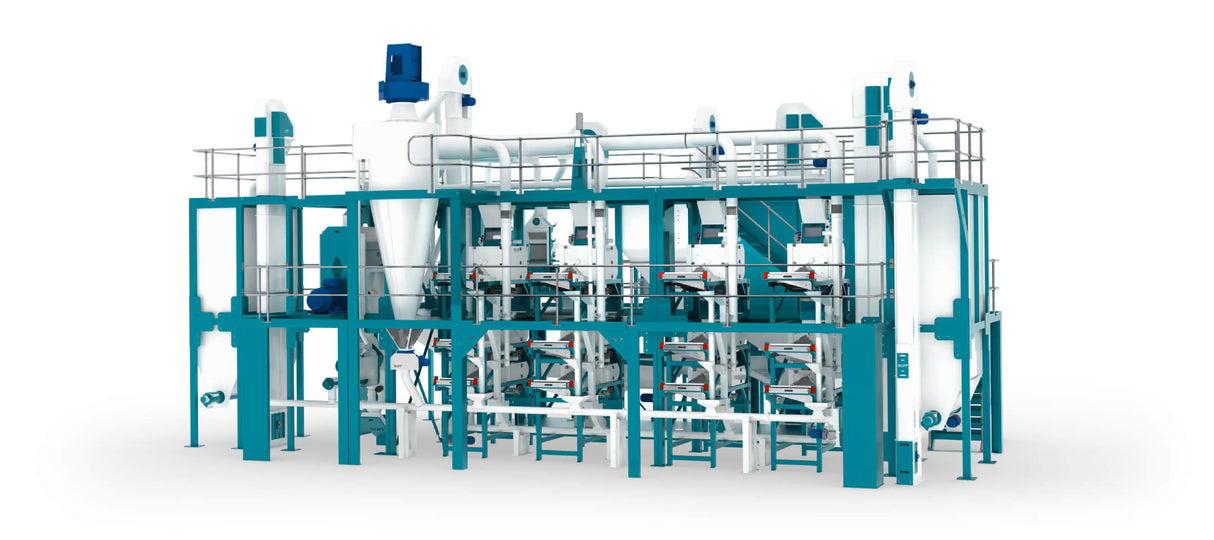

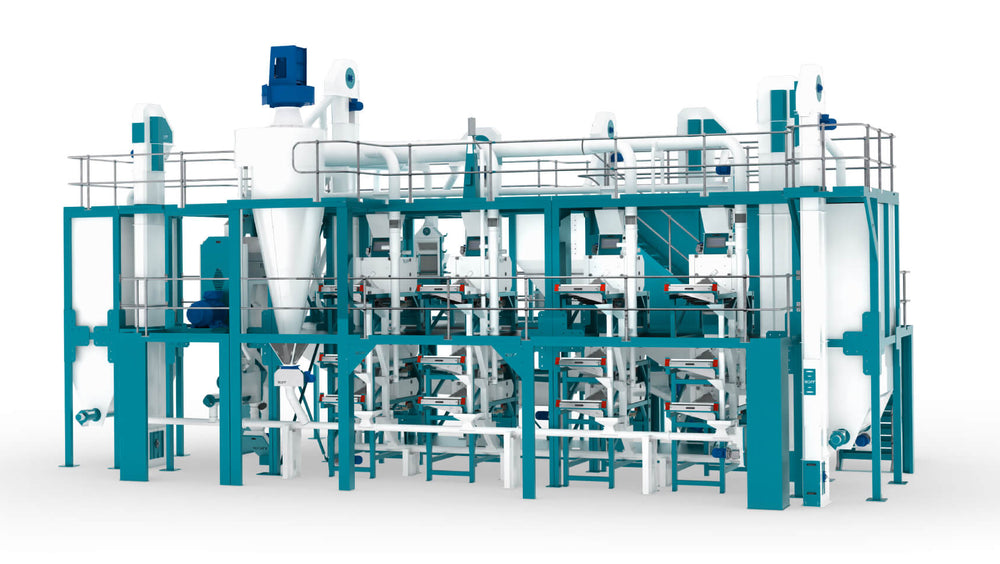

However, in order to fill the void left by the Russia/Ukraine conflict, it will be crucial for maize producers and millers to get their ducks in a row, e.g. by optimising their mills’ extraction rates, doing regular maintenance to keep rollers sharpened, and upgrading degerminators.

Let’s take a look at what to expect – in Africa and beyond – and how Roff can help African maize millers and entrepreneurs benefit from opportunities created by the conflict.

Interesting statistics

Russia accounts for 10% of global wheat production, and the Ukraine 4%.Both countries are also notable players in maize, responsible for a combined maize production of 4%. However, Ukraine and Russia’s contribution is even more significant in exports, accounting for 14% of global maize exports in 2020. In 2020, Ukraine’s sunflower oil exports accounted for 40% of global exports, with Russia accounting for 18% of the global percentage.African countries imported agricultural products worth US$4 billion from Russia in 2020.

Source: https://www.trademap.org

Impacts of the conflict on the world

Impacts of the conflict on the world

African countries will feel the impact on food prices, but is also set to benefit through maize exports

Commodity prices, including wheat and corn, have surged since Russia began its invasion of Ukraine on 24 February. Russia and Ukraine account for about 29% and 19% of global wheat and maize exports, respectively.With Ukraine’s ports closed and much of Russian grain supply frozen by Western sanctions, there are fears tightening supplies will lead to shortages in importing countries.

Maize producing African countries could however also benefit from maize exports if supplies from Ukraine remain curtailed.

Countries in the European Union, Middle East and Africa will face food shortages

Countries in the European Union, Middle East and Africa will face food shortages

Ukraine produces wheat, barley and rye that much of Europe relies on, analysts said. It’s also a big producer of corn. Even though harvesting season is still a few months away, a prolonged conflict would create bread shortages and increase consumer prices this fall.

Apart from the European Union, many nations in the Middle East and Africa also rely on Ukranian wheat and corn, and disruptions to that supply could affect food security in these regions.

China is also a big recipient of Ukrainian corn; Ukraine replaced the US as China’s top corn supplier in 2021.

Rising food prices

Wheat and corn prices were already soaring. Wheat futures traded in Chicago have jumped about 12% since the start of 2022, while corn futures spiked 14.5% in the same period.

Food inflation has been rising, and could worsen if the armed conflict escalates. Rising food prices would only be exacerbated with additional price shocks, especially if core agricultural areas in Ukraine are seized by Russian loyalists.

Increased costs will affect World Food Programme operations and impact the most vulnerable in the Ukraine

The World Food Programme (WFP) is working to minimise the knock-on effects of rising food and energy prices – triggered by the Ukraine conflict – on hunger around the world, while it looks to scale up operations within the country and reach 3.1 million people.

This could spell disaster for millions, as WFP had already warned that 2022 would be a year of catastrophic hunger, with 44 million people in 38 countries teetering on the edge of famine.

With Ukrainian ports closed and Russian grain deals on pause because of sanctions, 13.5 million tons of wheat and 16 million tons of maize are currently frozen in Russia and Ukraine, WFP’s report states.

Fertiliser shortages

Fertiliser shortages

Any disruptions to the natural gas supply will in turn affect the production of energy-intensive products such as fertilisers — and that’s bound to hit agriculture further. Fertilisers were already in short supply last year, leading to soaring prices.

Russia was the largest supplier of natural gas and oil to the European Union last year.

Supply chains disrupted

Oil and gas prices are set to spike further as the Russia-Ukraine crisis escalates, but the impact on energy won’t be the only ramification. From wheat to barley, and copper to nickel, analysts forecast that supply chains are set to be disrupted.

Opportunities for African maize producers and millers

Greater local maize sales

Since wheat will be scarcer and harder to come by, wheat prices will escalate, and naturally the price of bread will also increase. This creates a void that maize meal can fill as a staple food, creating opportunities for maize producers and maize millers.

However to capitalise on this opportunity, maize millers need to urgently put steps in place to ensure a steady supply of maize in order to meet this greater demand.

Greater grain exports

With maize becoming more in demand, extraction rates at maize mills will be crucial. For more information on how to achieve optimal extraction rates, you can read the following Roff blogs:

EXTRACTION RATES, A KEY CONSIDERATION WHEN INVESTING IN A MAIZE MILL

TROUBLESHOOTING FOR THE MILLER WHEN EXTRACTION RATES DROP

THE IMPORTANCE OF EXTRACTION RATES ON THE OVERALL MAIZE MILL PROFITABILITY

But the buck doesn’t stop with extraction rate, important as it is. Doing preventative and regular maintenance that includes sharpening rollers is critical, as is degerminator upgrades. Get in touch with Roff to book a service or to learn how we can support you with optimising your maize milling operations.

New opportunities

Times like these often create opportunities for those with an innovative mindset to find solutions to the challenges of the day. Is there, for example, a way to promote mealie-meal bread as an alternative to wheat bread?

While the world holds its breath for the Russia/ Ukraine conflict to be resolved, Roff Milling is ready to support our maize milling entrepreneurs and producers to offer solutions to the challenges presented.

Sources:

- https://www.news24.com/fin24/economy/war-in-ukraine-to-hike-sa-wheat-prices-may-boost-maize-exports-20220308

- https://www.cnbc.com/2022/02/23/impact-of-russia-ukraine-on-supply-chains-food-metals-commodities.html

- https://reliefweb.int/report/ukraine/food-security-implications-ukraine-conflict-march-2022

- https://www.moneyweb.co.za/news/markets/south-africa-sees-food-inflation-opportunity-from-russia-ukraine-war/

- https://theconversation.com/how-russia-ukraine-conflict-could-influence-africas-food-supplies-177843